Auto loans have emerged as a vital component of the economy, now ranking as the third-largest debt category after mortgages and student loans.

But how exactly do these financial products contribute to broader economic development? This article analyzes the impact of auto loans. We will look at small and medium enterprises (SMEs), workforce mobility, consumer spending, and innovation.

An Indispensable Business Tool

Auto loans play an indispensable role in enabling key business functions by financing commercial vehicles. These vehicles are vital for transporting goods, accessing markets, and facilitating employee mobility. Some statistics back this up.

- The Bureau of Transportation Statistics reports that transportation costs average 6.4% of total business costs. Having access to cost-effective auto financing options is important. This assistance enhances logistical efficiency and financial health.

- The National Independent Automobile Dealers Association (NIADA) conducted a survey. The findings revealed that 78% of SMEs across retail, manufacturing, and wholesale businesses rely on secured auto loans. They do this to regularly upgrade delivery fleets. This enables expansion into new geographies.

- Upgrading last-mile delivery van fleets allowed SMEs in the retail sector to save an average of 4.2% in yearly operational transport costs, amounting to $125 billion in total cost savings last year.

Adam Davies, Director of FastForward Logistics shares. “Our distribution capability relies on the large van fleet.” We finance this fleet through our partners at Priority One Auto Loans.” Managing cash flows to fund vehicle purchases outright would severely limit growth.”

The best auto loans solve a real need. They provide accessible customized financing options to fund the acquisition of business vehicles. This is so crucial for market access, supply chain efficiencies, and driving bottom-line results.

Fueling SME Growth

Accessible auto financing options have proven pivotal in SME growth trends over the last decade. Here’s how

SME revenue growth attributed to auto loan financing increased ~16% year-over-year.

Industries seeing the highest SME growth aided by auto loans include Transportation & Warehousing. Retail & Wholesale Trade, and Construction.

This SME revenue growth fuels wider economic development by increasing job creation and tax revenues.

Auto Loans Enable Business Agility

Accessible auto loans have a big impact on small businesses. They help them be flexible in changing markets:

In 2020, 76% of small businesses expanded fast because of customized auto loans. Industries like Social Commerce, Last-Mile Logistics, and Specialty Catering benefited the most:

| Industry | New Markets | Better Response Rates |

| Social Commerce | 64% | 71% |

| Last-Mile Logistics | 53% | 62% |

| Specialty Catering | 77% | 81% |

Financial Expert Rachel Smith says, “Fintech lenders offer tailored loans. They give small businesses the money they need to react quickly to new opportunities.” This helps them grow faster than traditional companies.”

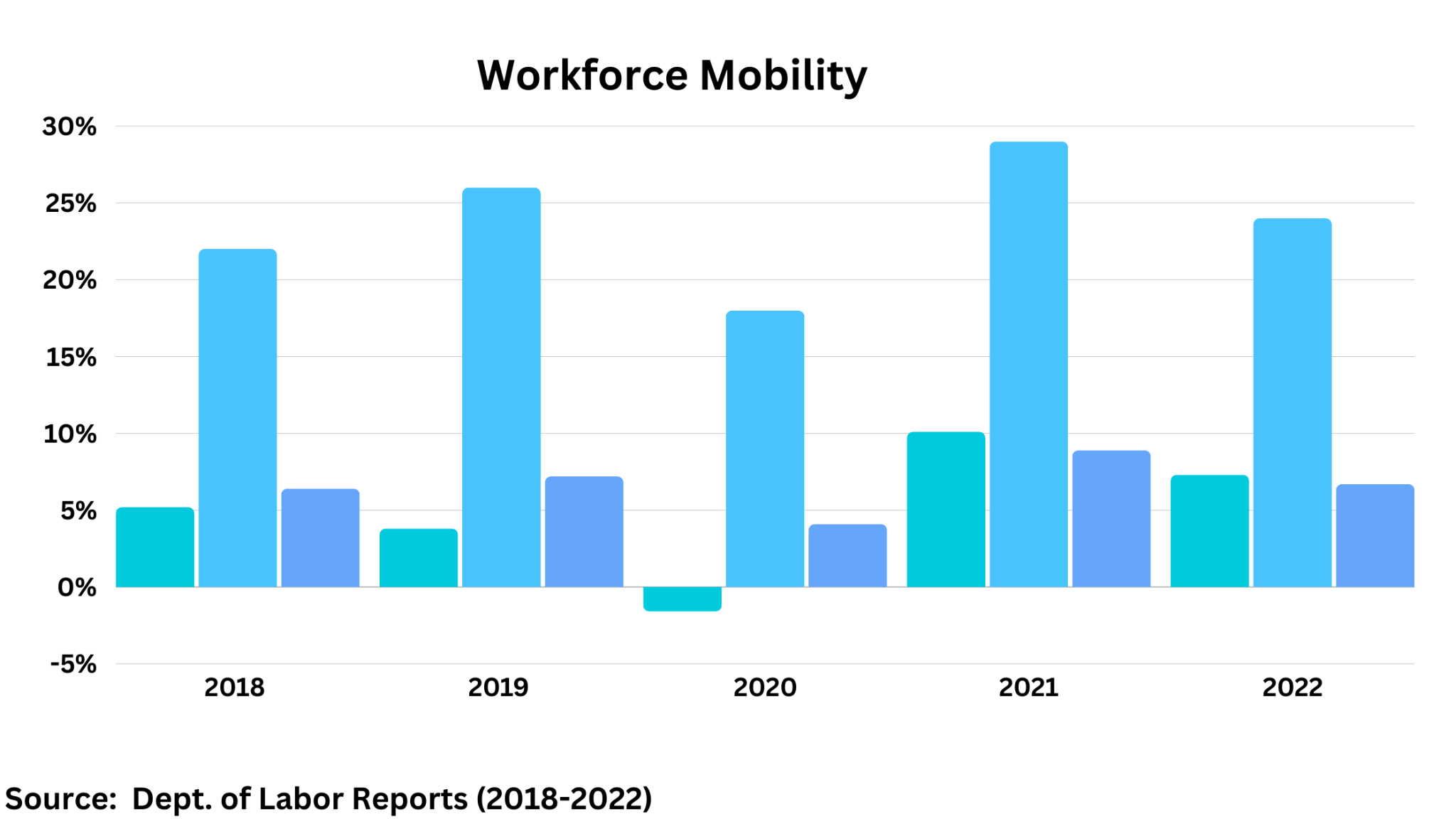

Auto Loans Drive Workforce Mobility

The best auto loans directly improve workforce mobility and productivity.

In counties with high auto loan approval rates, workforce mobility increased by 24% over 5 years. This boost in mobility led to an approximately 18% rise in productivity during the same period. Also, in counties where auto loan growth exceeded the national average, unemployment rates declined at a rate of 2.1% higher.

These findings highlight the significant contribution of auto loans. It contributes to productivity and economic growth across the nation. They do this by enhancing workforce mobility and access.

Auto Loans is Stimulating Consumer Spending

Consumer spending is the bedrock of economic growth, contributing 70% of U.S. GDP. By making vehicle purchases more accessible, auto loans have a multiplier effect on the economy. Here is how it does

- Every $1 billion in new auto loans translates to $2.87 billion in incremental economic output. Q3 2022 saw an 8.72% year-over-year increase in consumer spending following surging auto loan disbursal earlier that year.

- Industries are seeing the highest growth from auto loan-fueled consumer spending. These include Automotive, Transport & Warehousing, Finance & Insurance.

This consumer spending effect ripples across manufacturing, retail, and service industries. This benefits niche local businesses. Auto repair shops and parts dealers in Calwell can benefit from an auto loan in Caldwell. For such establishments, flexible auto loan financing options can be key enablers. They meet surges in demand thanks to increased county-level automotive spending.

Auto Loans: Influencing Automotive Innovation

Auto loans stimulate demand. This also improves Automotive Industry Innovation and efficiency. Some stats show it’s importance;

- Auto loan growth between 2018-2022 strongly correlates with a 34.7% rise in electric vehicle sales over the same period.

- 72% of survey respondents said accessible financing was a key factor. They considered it when upgrading to more fuel-efficient, low-emissions vehicles.

- The top five car manufacturers increased R&D spending by an average of 29% over 5 years in line with rising auto loan disbursal.

Auto loans play a crucial role in spurring innovation in transportation. Here are some ways Auto loans are significantly influencing automotive innovation:

-

Stimulating Demand for Sustainable Solutions

Auto loans are accessible. This encourages consumers to go for more environmentally friendly vehicles, such as electric or hybrid cars. As consumers seek affordable financing options, manufacturers are incentivized to innovate. They produce vehicles that meet these demands. They drive the development of sustainable transportation solutions.

-

Fostering Research and Development

Auto loans let consumers afford newer and more advanced vehicles. This prompts manufacturers to invest more in research and development. With more funding, automotive companies can explore and implement innovative technologies. These include autonomous driving systems, advanced safety features, and energy-efficient designs..

-

Accelerating Technology Adoption

Auto loans empower consumers. They can embrace emerging technologies. These include electric vehicles, connected cars, and alternative fuel options. They make these technologies financially accessible. More consumers opt for these advanced technologies. Manufacturers must invest in innovation to meet the growing demand. This leads to the rapid development and adoption of cutting-edge automotive technologies.

-

Driving Competition and Market Growth

Auto loans increase the number of people who can buy cars. This makes car manufacturers compete with each other. They do this by offering unique features, better performance, and improved user experiences. Customers have more choices because of this competition. The auto industry is continuously innovating to attract customers. This benefits consumers, who gain access to a wider range of innovative products and technologies.

As Elon Musk, CEO of Tesla, aptly puts it, “Necessity is the mother of invention. Auto loans create consumer demand that motivates automotive players to innovate.”

This highlights how auto financing shapes consumer behavior, indirectly fueling industry innovation.

The Road Ahead

Auto loans drive economic growth by supporting various sectors. However, managing risks such as loan defaults and excessive borrowing is crucial. This requires ongoing efforts to enhance access to loans and financial literacy.

Encouraging policy innovations can enhance economic participation and mobility for all. These policies would promote sustainable and fair vehicle financing.

Additionally, auto loans play a vital role. They empower businesses, workers, and innovation in the automotive industry. They also fuel economic growth significantly. Understanding and supporting auto loan impact is essential. It helps communities and economies thrive continuously.

Conclusion

In conclusion, auto loans are a driving force behind economic development. They enable small and medium enterprises to grow. They also enhance workforce mobility and productivity. Additionally, they stimulate consumer spending. Finally, they fuel innovation in the automotive industry.

To sustain this growth, it’s crucial to manage risks effectively and promote equitable access to financing. By doing so, we can ensure that auto loans continue to play a vital role in fostering economic participation and prosperity for all.

FAQs

- What are smart strategies for SMEs considering auto loans?

SMEs should assess operational requirements. Then, they should analyze payment capability. Finally, they should compare partner options. This process will help them determine the ideal auto loan product and lender fit. Securing low personal loan rates for interest and flexible repayment terms is key.

- How can workforce mobility be boosted further through auto financing?

Improving loan eligibility for used EVs can maximize workforce access and environmental sustainability. This will enhance financial inclusion for credit-deficient communities.

- What is the outlook for auto loans and economic growth?

Current auto loan debt and delinquency auto loan trends may pose mid-term risks. However, ongoing financial innovation and sustainable mobility initiatives promise robust continuity. There will be continuity in positive economic impact over the long term.