Who does not love the convenience and getting maximum output with minimal effort? We all enjoy shopping online, where you can access your favorite online retailer on your smartphone from the comfort of your couch while enjoying a great show on Netflix. Ordering anything you like, from pizza and groceries to electronics and furniture, and having them delivered on your doorstep is purely amazing. However, wherever money and convenience are involved, there is always a third-party villain on the lookout waiting for a straightforward loophole to steal your financial details and use them to steal your funds or make fraudulent purchases. That is why all shopping stores need to take online security very seriously, and a great way to do that is installing an SSL Certificate.

This article seeks to educate you, the online shopper, on measures you should put in place to ensure that your financial data is always safe whenever you go on a Black Friday or Cyber Monday shopping spree online.

Killer Hacks to Protect Your Financial Details Online

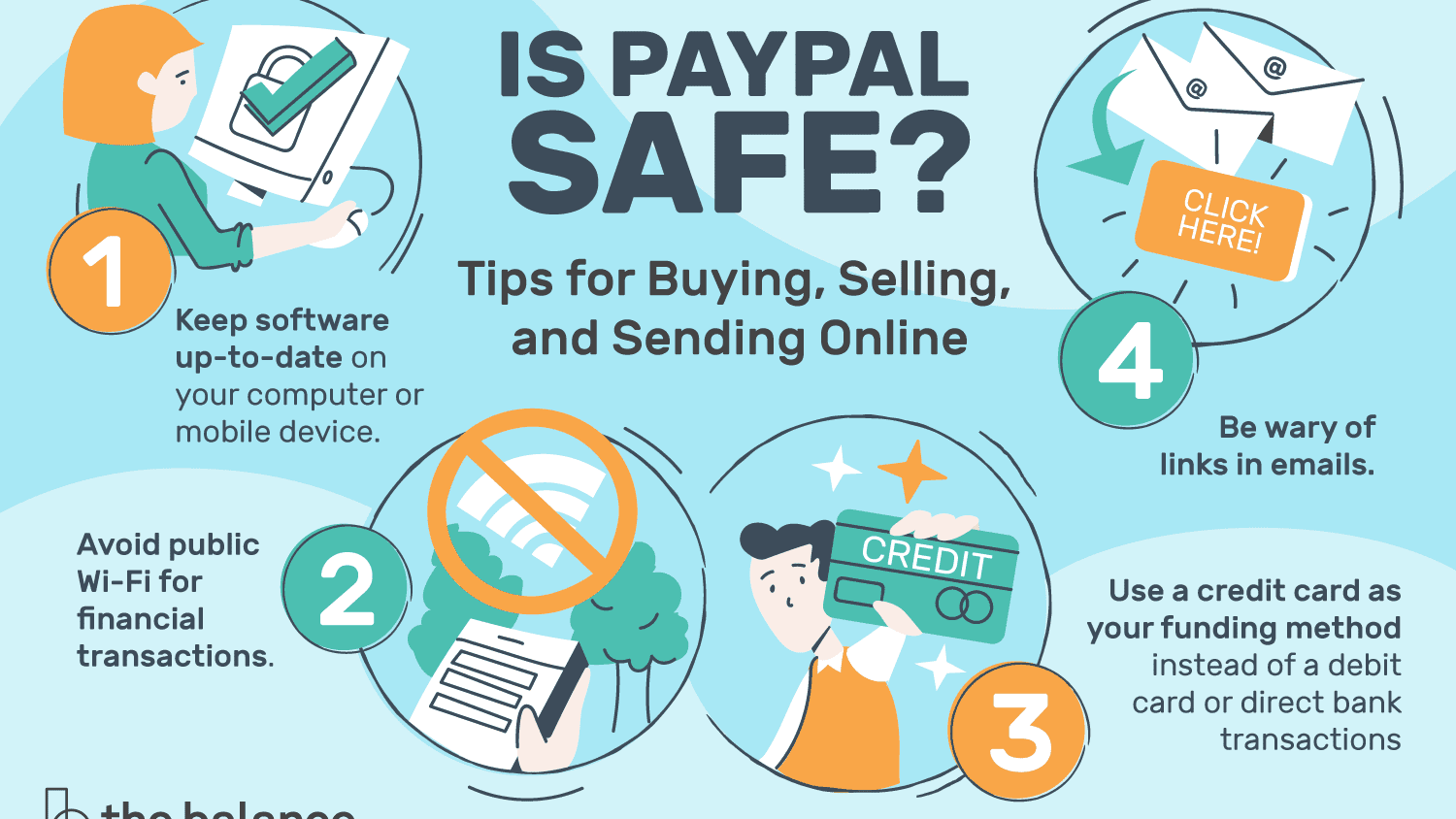

- Avoid Using Debit Cards

One great way to keep your financial data safe when shopping online is to avoid using debit cards at all costs. The reason is that a debit card is directly connected to your bank account, and if your details were to be breached, this would pose severe threats to the funds in your bank account. The best thing is to use credit cards. First, you are using the bank’s money and not yours when using a credit card, and they go to great lengths to safeguard it. This way, there is less liability for you than a debit card where it is solely up to you and the seller to sort out any mishaps during purchases. You can request your bank for a one-time virtual credit card number, which is safer than having to carry a plastic card around. Another option is to use online payment gateways like PayPal and Skrill.

- Only Shop from Secure Shopping Sites

Knowing how to look out for secure sites is imperative if you want to avoid financial fraud online. An excellent way to distinguish a safe and secure site from a risky one is checking whether an SSL certificate is installed. Usually, sites with SSL encryption have HTTPS instead of HTTP on the URL bar and a padlock to signify that the site is safe, and your data is encrypted to avoid tampering or falling into the wrong hands. Even better are shopping sites with an EV SSL Certificate installed because the URL bar shows a company name upon clicking on a padlock. You can see the business’s physical location as well as a site seal and HTTPS. These details will assure you that all your financial data will be safe.

- Use Strong Passwords

Although strong passwords have been emphasized since time immemorial, you will still be surprised to find people who use basic passwords like their birthdays and official names. This is putting yourself on the line, mostly where your finances are concerned, because a simple brute-force attack will crack weak passwords in no time. The best way is to create passwords that do not make sense using a mix of uppercase and lowercase letters, numbers, and symbols. You can use password generators to create strong passwords that are hard to crack. It would be best if you also used different passwords on all your accounts. If you have a hard time remembering them all, there are many efficient password managers out there.

- Enable Multi-Factor Authentication

Whenever you are making online payments, it is essential to have Two-Factor Authentication (2FA) enabled. This adds a layer of security to your transactions because, on top of the regular pin that you use with your card or payment gateway, there is an extra one-time pin (OTP) sent to your mobile device or email address. In this case, if a hacker managed to get your credit card pin, for instance, they would still not be able to cause you harm without the OTP sent to your phone.

- Be Careful with Email

Most online cyber-attacks have been known to slip through malicious links sent via email. Most times, hackers will impersonate reputable institutions like your bank, CDC, WHO, the UN, and such. Whenever you receive an email from an unknown sender, be very careful to cross-check the sender’s address and see if they are who they claim to be. If an email claims to be from your bank, instead of clicking any links, contact your bank directly on their official site and check whether they indeed sent the email. Another critical point to note is that most spammers know that you may be tempted to hit the unsubscribe button, and in this case, their bait is successful. Instead, it would help if you marked as spam.

- Keep Your Software, Browsers & Operating System UpToDate

Most times, malicious actors gain entry to our systems through outdated software, OS, and browsers. Make a habit of ensuring that you are using the latest versions and installing any released patches because that is usually meant to fix any discovered vulnerabilities that hackers can use. Keep in mind that hackers are always first to know when patches are released, and they will scan for systems and devices that are not yet updated.

- Use Proper Anti-Virus, Anti-Spyware, and Anti-Malware Software

Any country without an appropriately trained and equipped army is bound to fall in case of an attack. It would help if you beefed the security of your devices by having proper antivirus software in place. This way, if any harmful elements try to hijack your device, they will be quickly detected and quarantined or deleted. Appropriate firewalls are also necessary to block any malware from trying to come in.

- Avoid Public Wi-Fi

Although public Wi-Fi is as tempting as the apple in the garden of Eden, you should never shop online or make any financial transactions when on public Wi-Fi. Hackers like to frequent places like bars and coffee shops where people want to relax as they enjoy the free internet. Anyone within the same network can quickly steal your details if you have to use Wi-Fi and use a virtual private network (VPN) to effectively block anyone from trying to snoop on your browsing data.

- Limit Sharing Personal Information on Social Media

Most people make the mistake of oversharing details on social media. From your real names, date of birth, where you live and work, the places you frequent the most, and so on. Hackers can be very patient and can stalk you for as long as needed until they build a full profile of you. Only share the details that are necessary on social media networks as well as on shopping sites.

Conclusion

Online shopping is timesaving, convenient, and just amazing. We surely cannot wish to go back to the brick and mortar store days. However, before you punch in your credit card details to enjoy those fantastic offers, you found online, ensure that you have the above financial security tips on your fingertips. Any online store should install an SSL certificate to ensure that customer details are kept safe and secure.